It happened on I-94, just outside Milwaukee. One minute I was driving to my second job — the next, smoke from the hood, engine dead. The tow truck driver said: “Radiator’s shot. $350 to fix. You need it by 5 PM or they’ll scrap it.”

I had $22. My credit score? 510. Banks said no. Family was tapped out. And if I lose this car, I lose both jobs.

If you’re reading this because your car just broke down and you need cash today — you’re not alone. Here’s what actually works when time is running out.

Option 1: Call Roadside Assistance or Insurance

If you have AAA or full coverage insurance, they might cover towing or repairs.

But be honest: Most basic plans don’t cover mechanical failures. And even if they do, approval takes days — not hours.

Option 2: Borrow from Friends or Pawn Something

Yes, you can sell your phone or laptop. But you’ll get $80 for a $400 phone — and you need that laptop for work.

Asking friends? Most are stretched thin too. One “no” after another kills hope fast.

Option 3: Use a Same-Day Cash Access Tool

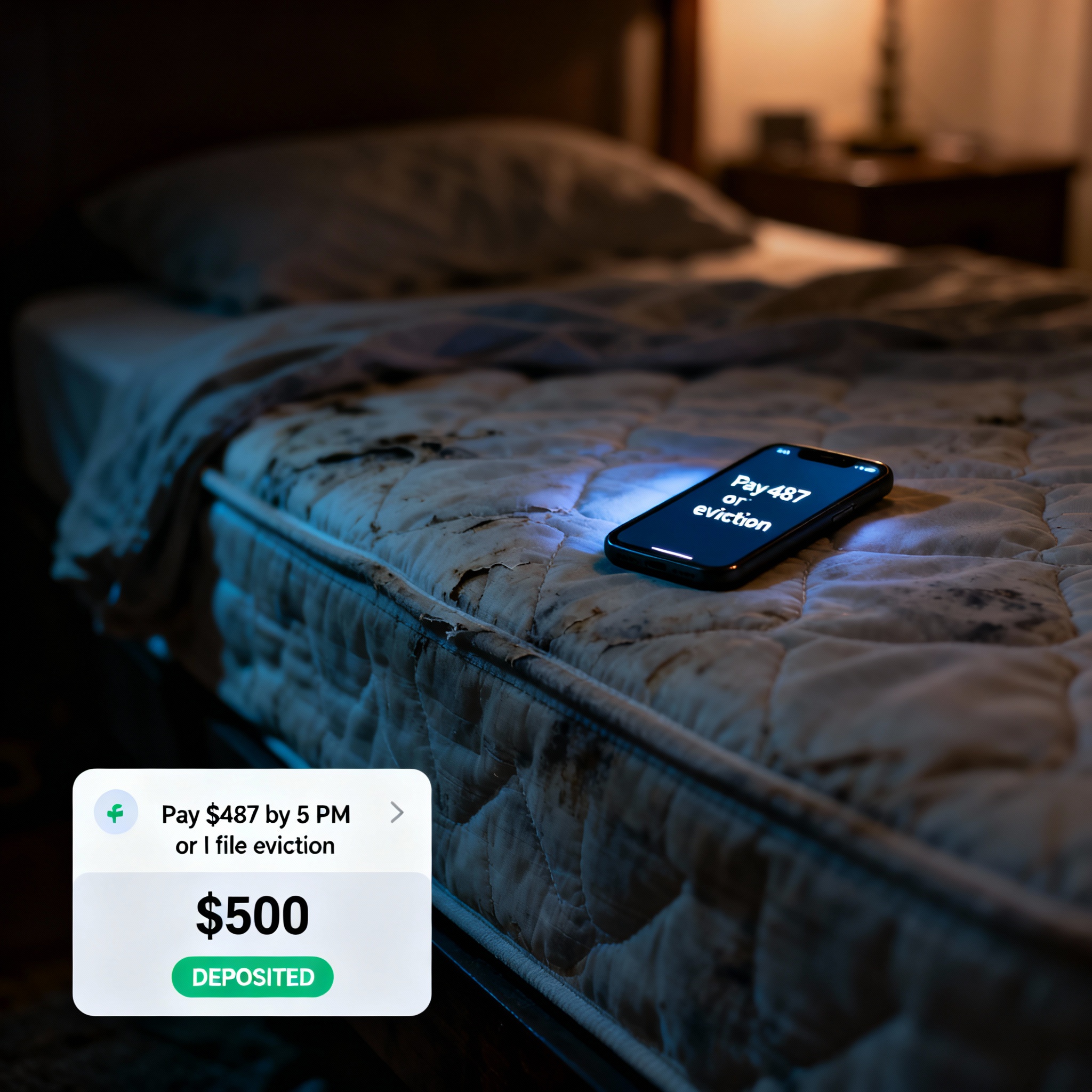

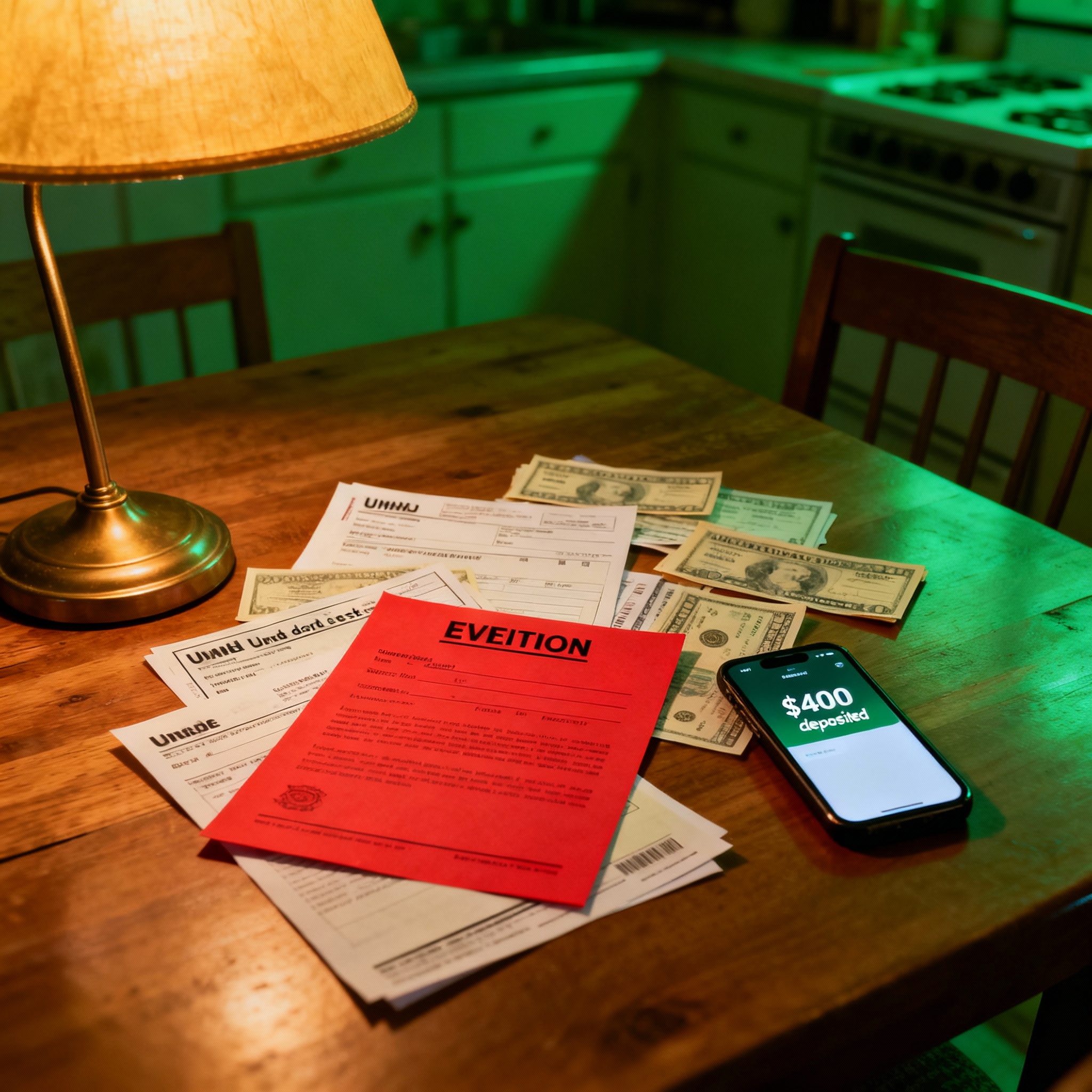

Last week, Marcus from ZIP 53218 used a private funding network that connects people with emergency cash — no bank, no credit check.

He filled out a 2-minute form at 1 PM. By 2:47 PM, his phone buzzed: “$400 deposited.” He paid the mechanic. Got his car back. Made it to work.

This isn’t a loan from a bank. It’s direct cash for people in real emergencies — designed to move faster than the system.

If your car is in the shop right now, and you need cash before they scrap it, you can check eligibility in under 90 seconds:

👉 Check If You Qualify for Emergency Car Cash (USA Only)

No credit check. No waiting. Just a real chance to keep your car — and your life — moving.

Final Thought

When your car breaks down, it’s not just metal — it’s your job, your kids’ school run, your freedom. Don’t wait. Act now. Every hour counts.